[ad_1]

Some SMEs really do not want to get (or have accessibility to) equity funding, but also want to continue to be away from higher-fascination financial institution loans. Which is the hole that profits-based mostly financing platforms like GetVantage want to fill. The Mumbai-dependent startup introduced now that it has lifted $36 million led by Varanium Nexgen Fintech Fund, DMI Sparkle Fund, together with returning traders Chiratae Ventures and Desire Incubator Japan. Varanium Money spouse Aparajit Bhandarkar will be a part of GetVantage’s board.

Other members bundled Sony Innovation Fund, InCred Money and Haldiram’s Loved ones Workplace. This delivers GetVantage’s complete raised so much to $40 million, alongside with a seed spherical in 2020, the exact calendar year it was launched by Bhavik Vasa and Amit Srivastava. GetVantage claims it also has several financial debt lines with non-banking economical firms to help scale its funding system.

Vasa instructed TechCrunch he co-launched GetVantage just after doing the job as chief progress officer at fintech Itzcash. “I arrived throughout the ‘ad for fairness design,’ a barter deal wherever media properties choose a certain stake in providers in return for marketing and promotions on their platform.” He then moved onto a job at remittance system EbixCash and immediately after quitting, he claimed he kept wondering of a way to supply option financing to startups.

“The traditional procedure of increasing money is advanced, cumbersome and simply just doesn’t perform for all enterprises and small business house owners,” Vasa said. A lot of on the net business people are underserved, he included, due to the fact “the VC model is somewhat broken and genuinely dependent on who you know.” For founders without the suitable network, it is tough to come across traders. Some also want not to offer handle and dilute possession in their providers.

Vasa reported he and Srivastava’s background as founders give them an edge, simply because they comprehend the wants of other founders. The two fulfilled while managing the Startupbootcamp fintech cohort.

GetVantage provides SMEs fairness-cost-free cash between $10,000 to $500,000 USD, with applications processed in about two times, and resources produced available in 5. It says that about 4,000 enterprises have used for non-dilutive financing via its system so much, getting a complete of $270 million in funding. Some of its customers consist of Arata, BoldCare, Eat Far better, Jade Forest, Naagin, Nua Wellness, Rage Espresso, Sid Farms and Zymrat.

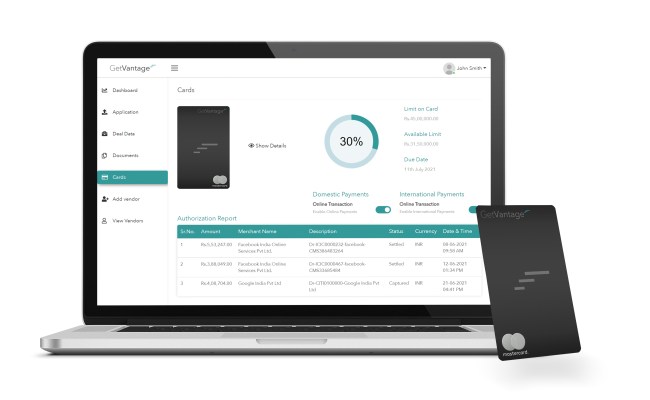

Funding choices are made working with the company’s algorithms, which it suggests allows get rid of bias and make the software procedure more rapidly. Its main tech is a proprietary device-based finding out model referred to as the Credit rating Conclusion Motor and cloud-centered Deal Administration System.

Firms applying for cash hook up their electronic marketing platforms, like Google or Fb, and revenue accounts which include Shopify, Amazon, RazorPay or Stripe, to GetVantage’s platform. By doing that, they share their business’ paying out and earnings for the past 12 months. GetVantage’s Credit Selection Motor then generates a personalized term sheet in about 48 hrs. After obtaining funds, clientele then repay a pre-determined share of their revenue until eventually they’ve paid back again the comprehensive principal.

Vasa stated corporations generally repay financing in about six to nine months. There is no desire, and the firm rates flat service fees concerning 6% to 12%. “What is vital to realize is that repayments are adaptable and wholly linked to revenue,” Vasa reported. “So if income goes up, a enterprise finishes up spending back a minimal far more in a specific thirty day period. If earnings goes down for some motive, the company pays back a small a lot less that month.”

GetVantage is sector- and measurement-agnostic, focusing on organizations with strong fundamentals, recurring revenues and a earnings-classic of amongst six to 12 months. Its clients have come from sectors as varied as SaaS, direct-to-customer e-commerce, edtech, wellness tech, cloud kitchens and nourishment. The firm statements that it saw 300% year-above-calendar year growth in 2021, and assisted its consumers accomplish 1.8x earnings growth following obtaining funding by GetVantage.

For business people, GetVantage also has partnerships with a range of enterprises, together with in promoting, gross sales, logistics and payment gateways. For case in point, vendors on some e-commerce marketplaces can apply for GetVantage funding directly by means of them, or by many payment gateways, advertising and marketing and logistics platforms.

In the lengthy-phrase, GetVantage has its eye on Southeast Asia and the Middle East as probable marketplaces, but for the time-becoming, it is “laser-focused” on India, Vasa explained, citing statistics that say the market possibility for income-based mostly funding is now $5 billion to $8 billion and predicted to expand to $40 billion to $50 billion as the immediate-to-client market expands to $100 billion by 2025.

In a prepared assertion, Bhandarkar reported, “At Varanium we look to lover with founders and teams that have a daring tactic to fixing huge issues. We are thrilled to aid Bhavik and the GetVantage management crew to enable accelerate GetVantage’s upcoming phase of growth and unlock capital and revenues for 1000’s of fast-escalating enterprises that will electricity the future of India’s digital financial system.”