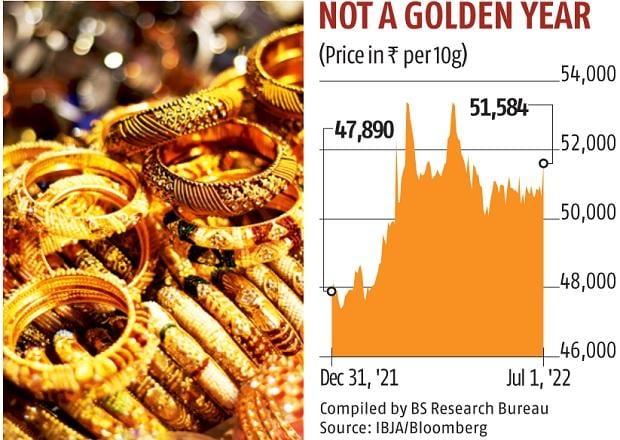

The sharpest boost in the import responsibility on gold by the Centre saw the yellow metal’s price tag mounting sharply in the domestic current market on Friday. The govt experienced hiked standard Customs responsibility on gold by 5 percentage points by way of a notification on June 30. Gold domestic futures jumped by about 3 for every cent to in excess of Rs 52,000 for every 10 gram in original investing.

By evening, it was buying and selling 2.2 for each cent greater at Rs 51,620, though the place cost in Mumbai shut 1.83 per cent larger at Rs 51,584. Interestingly, specialists explained the value rise should have been bigger but for particular things, which may perhaps hold rates beneath look at in the in close proximity to-time period.

Friday’s transfer is amid measures to curtail domestic demand from customers for gold, following the enhance in gold import monthly bill in the economical calendar year 2021-22. Since the very last two fiscal many years, India’s gold import monthly bill has been more than 8 for each cent of the whole import invoice, and it is also placing force on the dollar-rupee trade price. The import duty hike on gold need to be seen in this context, truly feel professionals.

While the authorities retained the import obligation on silver unchanged, it has withdrawn the .75 for each cent social welfare surcharge, which requires the full import obligation on gold to 15 for each cent from 10.75 per cent previously. Alongside with these variations, the import duty on gold for refineries has been raised from 6.9 for every cent to 11.85 per cent.

Notably, some industry experts believe that that although price ranges could not sustain at these concentrations, the ramifications of the duty hike are probably to be adverse for the Indian marketplace.

Somasundaram PR, regional chief govt officer (CEO), India, Environment Gold Council, stated, the go to raise responsibility will have adverse penalties for the gold industry and the gray industry (unofficial imports) will see a rise.

He reported, “The boost in import duty on gold from 7.5 per cent to 12.5 for each cent aims to lessen gold imports and relieve macro-economic strain on the rupee. Having said that, in general taxes on gold have risen sharply from 14 for every cent to all around 18.45 for every cent. Unless this is tactical and short-term, it will probably fortify the gray industry, with extended-phrase adverse effects for the gold sector.”

In the meantime, at the futures marketplace, many traders have been shorter but a falling rupee is furnishing guidance to selling prices. Furthermore, some traders who actively trade based mostly on the gold-silver ratio experienced offered gold and acquired silver. This is simply because the rate of silver was really low in relation to gold.

They, much too, were being caught unawares. Though some small-masking by these gamers may well have led to the initial surge, prices did not sustain. Sector players reported the cost of gold should really have risen by all over 4 for each cent because of to the duty hike. They additional that the lower enhance may perhaps be due to the higher domestic stock.

Kishor Narne, director, Motilal Oswal Money Products and services, mentioned, “The sudden surge in responsibility was taken effortlessly by the gold industry, as there was excessive inventory thanks to deficiency of demand from customers over final month. Thanks to this, comprehensive transmission of duty did not transpire.”

Ajay Kedia, director at Kedia Advisory, explained, “Friday’s attain in gold on MCX will be limited-lived as this is only because of the duty hike. Whilst this will dent world wide gold need, the hawkish tone from the US Fed won’t aid gold to sustain in the near time period.”

Dear Reader,

Dear Reader,

Organization Typical has constantly strived challenging to supply up-to-date data and commentary on developments that are of desire to you and have wider political and financial implications for the nation and the world. Your encouragement and regular feed-back on how to boost our providing have only produced our resolve and dedication to these ideals more robust. Even for the duration of these complicated times arising out of Covid-19, we continue to stay fully commited to keeping you educated and up-to-date with credible news, authoritative sights and incisive commentary on topical difficulties of relevance.

We, even so, have a ask for.

As we battle the financial effect of the pandemic, we require your assist even far more, so that we can continue on to present you extra good quality content material. Our membership model has found an encouraging reaction from several of you, who have subscribed to our on-line information. A lot more membership to our online content material can only help us obtain the aims of offering you even greater and a lot more appropriate content. We feel in free of charge, good and credible journalism. Your support by means of more subscriptions can assistance us practise the journalism to which we are committed.

Help high-quality journalism and subscribe to Organization Standard.

Digital Editor