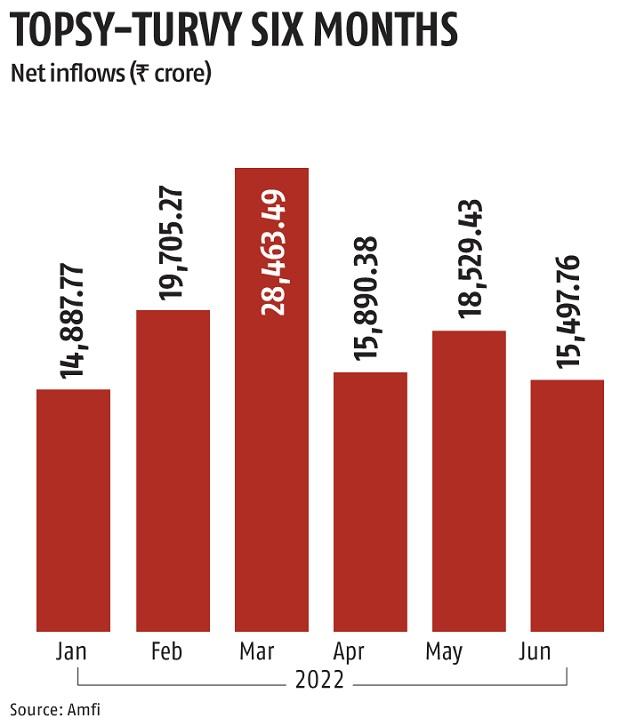

Inflows into fairness-oriented mutual fund (MF) strategies moderated in June amid the sharp selloff noticed in the inventory prices owing to anxieties of a global recession. Internet inflows stood at Rs 15,498 crore, 18 for every cent underneath the 2022 normal of Rs 18,829 crore and 16 for every cent down below May’s tally of Rs 18,529 crore. Having said that, sustained inflows into systematic investment designs (SIPs) endured for the 16th straight month.

On June 17, the market experienced dropped to its most affordable level because May 2021 and various mid- and small-caps experienced slipped into bear industry territory amid massive outflows from international portfolio buyers (FPIs). Thanks to a recovery in the latter part of the month, the S&P BSE Sensex Index ended the month with a loss of 4.6 per cent, when S&P BSE Midcap Index and S&P BSE Smallcap Index fell 6.2 for every cent and 6 per cent, respectively.

Market players said sustained inflows despite corrections in the markets is a indicator of maturity among traders.

In June, all fairness fund sub-types logged web inflows. Internet flows of more than Rs 2,000 crore were noticed in in flexicap and largecap types.

Arun Kumar, head of study, Resources India says, “Despite substantial FPIs marketing about the final various months, the industry influence has been fairly contained thanks to the solid domestic institutional traders (DII) flows. Typically, every time markets are volatile and a single-year (rolling) returns change lacklustre–as is going on now–DII flows have a tendency to weaken. We will need to maintain a shut enjoy on the equity MF inflows and SIP craze in the coming months as they are crucial supplied the backdrop of strong FPI outflows.”

Inflows as a result of SIPs stood at Rs 12,276 crore in June, a little reduce than Rs 12,286 crore found in May possibly.

The number of SIP accounts strike a fresh new all-time high of 55.4 million. The belongings underneath administration (AUM) for SIPs stood at Rs 5.51 trillion.

Passive schemes also saw web inflows of Rs 13,110 crore, though hybrid money observed web outflows of Rs 2,279 crore owing to the high redemptions from arbitrage resources.

Financial debt cash noticed outflows of Rs 92,248 crore. Commonly, the very last thirty day period of every quarter credit card debt money see large outflows as institutions this kind of as banking institutions and corporates redeem their investments to pay for advance taxes.

Greatest outflows had been observed in right away funds at Rs 20,668 crore adopted by liquid funds and ultra brief duration cash. Other shorter-end categories of money like lower period funds, revenue current market cash and shorter duration resources also noticed sharp net outflows.

Kavitha Krishnan, senior analyst – supervisor study, Morningstar India says, “An uncertain macro setting, driven by expectations all around an increasing price cycle, larger commodity charges and slowdown in development have possible led to buyers steering obvious of personal debt resources. One digit returns, soaring bond yields and the climbing inflation have also possible led to buyers deciding on to redeem their investments in personal debt resources in favour of other expense avenues.”

Web outflows for the marketplace throughout all types stood at Rs 69,853 crore and common AUM stood at Rs 36.98 trillion in June.

Expensive Reader,

Expensive Reader,

Organization Regular has constantly strived hard to supply up-to-day information and facts and commentary on developments that are of fascination to you and have broader political and economic implications for the nation and the earth. Your encouragement and consistent feed-back on how to make improvements to our presenting have only designed our resolve and commitment to these ideals more robust. Even in the course of these tough periods arising out of Covid-19, we proceed to continue to be committed to maintaining you educated and current with credible information, authoritative views and incisive commentary on topical problems of relevance.

We, nonetheless, have a ask for.

As we battle the economic effects of the pandemic, we have to have your aid even far more, so that we can continue on to supply you a lot more high-quality articles. Our membership model has noticed an encouraging response from lots of of you, who have subscribed to our on the net written content. Much more membership to our on line information can only assistance us achieve the aims of supplying you even greater and extra relevant articles. We consider in free of charge, good and credible journalism. Your guidance as a result of additional subscriptions can enable us practise the journalism to which we are dedicated.

Aid good quality journalism and subscribe to Enterprise Conventional.

Electronic Editor