Contents

Companies from across the industrial spectrum normally count on a migrant workforce, with data from the Global Labour Business indicating that some 169 million workers travel abroad for work. But staying absent from their domestic jurisdiction and financial infrastructure presents a host of difficulties, such as what is most likely the most significant aspect for the employee on their own — how ideal to get paid out.

From the company’s standpoint, in the meantime, they might have to administer payments for personnel hailing from multiple distinctive spots, a lot of of whom are in momentary or shorter-time period placements.

Controlling all of this administration, and ensuring that the employees are compensated in fantastic time, is more difficult than lots of on the exterior could know. And it’s a trouble that German startup Kadmos is location out to deal with with an conclusion-to-conclude platform that can help employers remove the friction and quite a few of the fees involved with paying out their cross-border workforce.

Just 4 months right after saying a $8.5 million seed round of funding, Kadmos these days unveiled it has additional a further €29 million ($29.5 million) to the pot via a sequence A tranche led by Blossom capital, with participation from Addition and Atlantic Labs.

The challenge

Provided that migrant personnel are — by definition — away from home for the particular intent of employment, they also require to be ready to expend what they get paid. From time to time they may get compensated in hard cash, which usually means they can devote the cash locally, but then they may be faced with exorbitant transfer service fees when it will come to getting the income house with them. On leading of that, quite a few migrant personnel want to ship revenue house to their family, which is often a chief motive for them operating abroad in the initial put — all over again, they may be strike with sizeable fees with money transactions.

Alternatively, a business may possibly elect to shell out their workers by intermediaries this sort of as regional banks, remittance corporations, organizations, or other 3rd-get-togethers, which not only involves a ton of expenses, but important paperwork and delays as well.

A very little much more than a year on from its inception, Kadmos is by now functioning with transport corporations who are utilizing an early iteration of its service to fork out their seafaring workforce.

How it functions

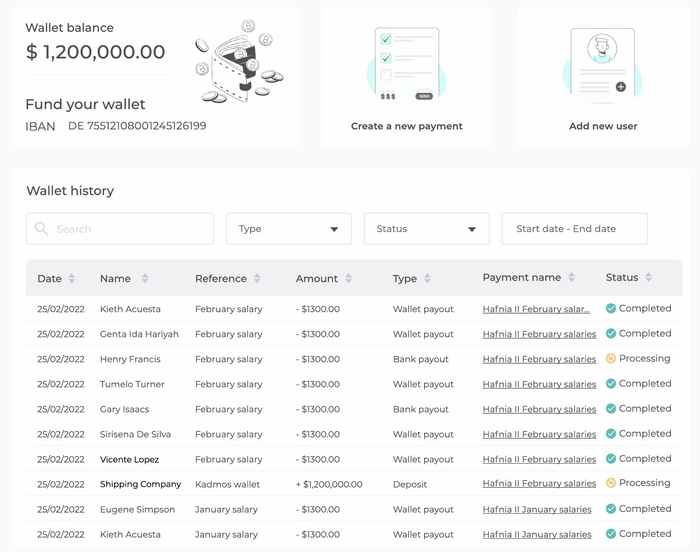

For companies, Kadmos provides a centralized salary payments platform for creating and monitoring payments, irrespective of where the worker hails from.

Kadmos for businesses

In terms of how all of this is set up, an worker should of training course be doing work for a business that has resolved to use Kadmos. The employer onboards them through their personal dashboard, and the worker receives a url to down load Kadmos and signal up.

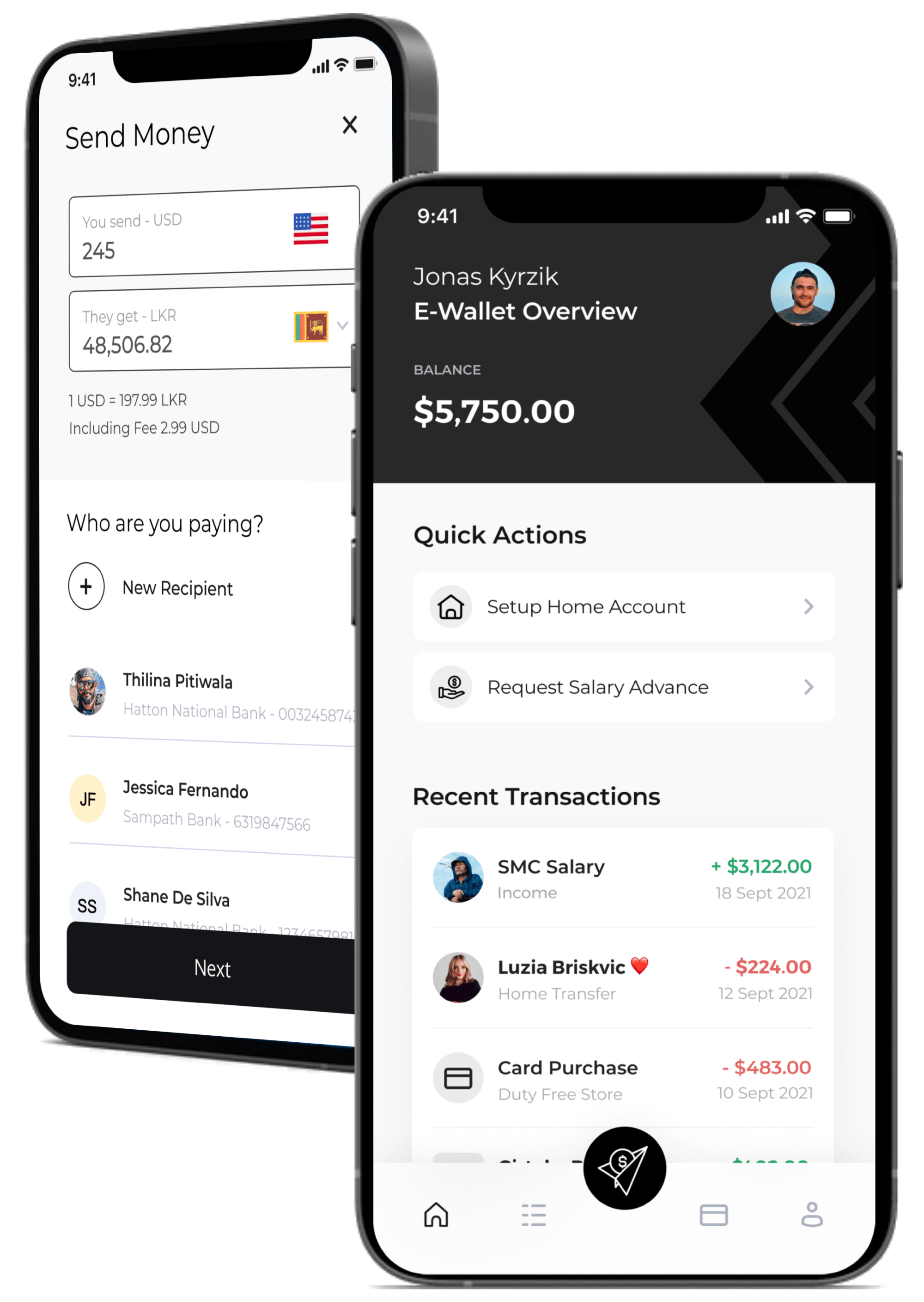

On the worker side, Kadmos serves up a cell application replete with e-wallet that holds workers’ salaries in U.S. bucks or euros, although also permitting them to send out cash household instantaneously, with predictable set fees. And importantly, Kadmos also gives personnel with their individual debit card that is tied to their electronic wallet.

Kadmos mobile application

Instinctively, restricting payments to euros or bucks may be a small on the restrictive facet, particularly given that migrant staff will likely be coming from any amount of nations in the planet, and touring to an similarly vast number of countries. However, cofounder Sasha Makarovych pointed out that the transport field mainly pays in those people two currencies.

“The present-day business demands are predominately for USD and EUR, due to the fact these are the currencies with which seafarers are paid,” Makarovych instructed TechCrunch. “For seafarers, it is a sizeable benefit to be able to hold their salary in ‘hard currencies’ (i.e. a stable currency).”

This does, of system, indicate that personnel will probably have to transfer funds commonly, both when they are expending it, or sending it property. And this is where by Kadmos’ sub-1% markup enters the fray, which Makarovych claims compares favorably to the regular 1.5-4.5% that common banking companies could cost. So if they use their debit card to expend pounds / euros in a region with a unique currency, they will routinely be billed at the Kadmos amount.

Even so, if the firm extends into other industries in the future, is there scope for Kadmos to offer personnel alternatives to get paid in other currencies?

“Yes, we are hunting into these alternatives,” Makarovych reported.

A modern fintech

In impact, Kadmos embodies the modern day fintech movement. It has many of the benefits of a present day challenger lender these kinds of as Monzo, in addition to cross-border payment attributes equivalent to the likes of Wise or remittance platforms these kinds of as Remitly. But in accordance to Kadmos’s other cofounder Justus Schmueser, the most important position to all this is that it is not just yet another B2B or B2C fintech — it is developed to clear up a incredibly specific problem.

“Kadmos’ tactic can be classified as B2B2C,” Schmueser mentioned. “In this sense, our scalability and value of acquisition is much a lot more economical because obtaining a couple of distinct companies who use Kadmos to pay out their workforce can direct to hundreds of new close-people for the Kadmos application.”

By solving two problems at when — encouraging migrant personnel get compensated, and alleviating quite a few of the fees and administrative burdens for companies — Kadmos sits in a really strong placement as the earth carries on to emerge from lockdown and typical enterprise resumes.

“We want to make the payment process simpler for corporations, and at the same time make the process of getting and expending that cash a lot easier for the personnel as properly,” Schmueser extra. “Kadmos’ focus is really on making use of technology to supply a solution to the extreme limitations put on the financial flexibility of cross-border workers.”