Contents

When it comes to putting your structured settlements on sale, annuities are certainly considered a favorable way to do so. The foremost perk is that they act as a guaranteed income with time and are 100% tax-free. If you may plan to sell your structured settlement to buyers, there are several things to keep in mind. The reason behind selling them could be funding an education program, buying a new home, paying off debts, making home renovations or repairs, investing, starting a new business, paying taxes, etc.

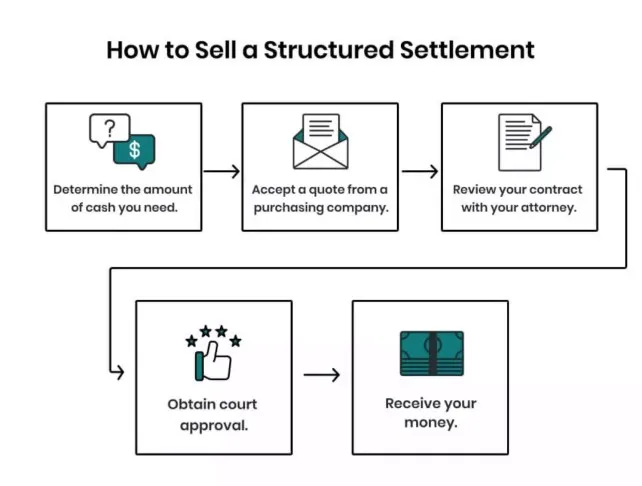

Today, our quick post will take you through a series of steps that will answer your question, “How to sell my settlement payments?”

So, let’s get started with this quick rundown.

Step 1 – Knowing the Purpose

If you later have some plans to invest in a significant purchase or are facing financial hardship, receiving cash for structured settlement payments can greatly improve your life. Well, we have to say that it is the legal right that follows a court process. This is why it is mandatory to have a valid reason before beginning the selling process because the judiciary would be the last person who would approve your reasoning and regulate whether selling it is in your best interest or not.

Step 2: Look Around for a Funding Firm.

Without any doubt, the options around you may leave you overwhelmed initially. However, your focus should stay on choosing an established funding organization known for its exceptional customer service, cash advance facilities, expertise, free estimation, complimentary consultation, and valuable advice. What else can make a big difference? Having an expert team by your side trusted by hundreds, that provides valuable suggestions ensuring putting your family’s financial present and future in a safe place? You can even hire experts who help you connect with the most reliable settlement companies.

Step 3 – Covering the Basics

Once you have decided to sell your settlement and have the best plan of action shared by your expert, you’re all set to move one step further. The hired expert will help you with a simplified process that also covers the annoying paperwork. With the authorized signatory, the lawyer will put your identification, application, settlement agreement, annuity contract, and letter mentioning benefits altogether.

Step 4 – Submitting the Application

The next step in the row is to complete the paperwork and file it with the legal court. Normally, you can expect the legal authorities to revert within 3-5 weeks, followed by the documentation review and a final hearing date. With this, you need to keep in mind that the assigned timeline may fluctuate from state to state as the governing laws differ.

Step 5 – Receiving Cash in Hand.

Once the court reviews your application and approves the transaction, you are almost there to your goal. The court will send a final order mentioning that you will be receiving cash for the structured settlement payments within the next 48-72 hours.

We hope that our quick rundown has explained to you all about the process. This may seem quite easy. But in actuality, there’s a lot more involved. This somehow makes it evident to hire an expert firm that is readily available to guide you throughout the sales process with absolute transparency and ensuring the best outcome possible. In addition, having a data and technology-driven firm will streamline the process to locate the best-structured settlement buyers and provide you with the knowledge to make the right decision.