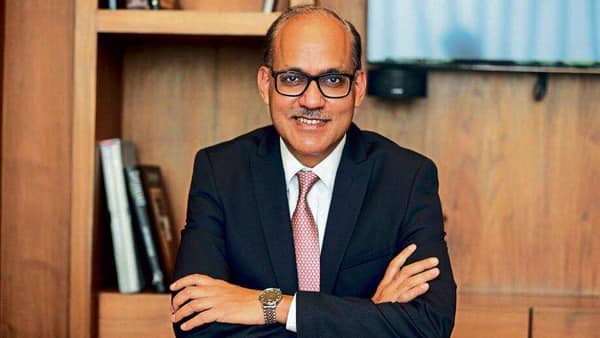

MUMBAI : State Financial institution of India (SBI), the country’s greatest lender, desires to use granular data created in its branches every day to predict tension and pre-emptively act to defend its harmony sheet. Accordingly, the condition-owned loan company is seeking at means to use innovative analytics to sift by way of information and obtain patterns that point out incipient worry. In an job interview, Ashwini Kumar Tewari, controlling director in charge of risk, compliance, and stressed property at SBI, defined how the lender digitized some stressed asset administration processes. Edited excerpts:

What sort of tension are you seeing amongst retail and small business borrowers?

Most of our retail buyers are salaried consequently, we do not see any problem. Our non-salaried established, while little, is dealing with some anxiety, but the web amount taken alongside one another is quite underneath control. Even though the cashflows to the micro, smaller and medium organization (MSME) segment have been plainly impacted but our lending parameters to this phase are really stringent. We do not give them an equivalent financial loan amount as salaried debtors, and the bank loan-to-benefit is also decrease. Even in the salaried section, people lost work and had their salaries minimize, but since we do not go down to the low credit score rating profiles, our general knowledge in covid-19 has not been adverse.

Has know-how assisted turnaround time in pressured asset resolution?

For one particular-time settlement and compromise, we have an open platform where a man or woman can apply on the web alternatively of coming to a department. Internally we have a dashboard to keep track of this at the operational stage as very well as the administration amount. We are as a result in a position to manage the turnaround time and see the quantum of recoveries. The authorized team is a main part of the pressured assets vertical. We have an application named the Litigation Management Process with modules these kinds of as the National Organization Regulation Tribunal (NCLT), the personal debt restoration tribunal, and courts. Here, the whole case history is obtainable and offers reminders for files that appear up for renewal for the next hearing, among other points. We have also digitized the wilful defaulter management technique.

What are some of the new know-how initiatives your office has prepared?

We have so considerably details in the method. It would be valuable to leverage this information not only from the chance standpoint but also to see how points are shifting in authentic-time in several sections of the nation and various sectors. This is one particular location where we would like to use synthetic intelligence and machine studying. Correct now, our analytical groups are embedded in the risk, items divisions and operational possibility places. We get all the non-doing asset (NPA) data from throughout the nation, such as individual account information, and the aggregation takes place at the circle level. Say there are difficulties in the steel sector in a unique condition a single way to know is to observe media stories but is our databases demonstrating impending tension from that location? Just after it will become NPA, it will have to be dealt with, but if there are early indicators of anxiety, then this can be taken care of proactively.

Do you assume it is faster to resolve pressured financial loans outside the house the purview of the Insolvency and Bankruptcy Code (IBC)?

In a couple of cases where we recognized that getting upfront dollars is critical and the course of action itself may perhaps take a extended time, it is improved to market to asset reconstruction organizations.I believe there are specified modifications becoming contemplated in IBC. If they transpire, like pre-pack insolvency for corporates, we may possibly have some extra conditions dealt with better. Absolutely everyone talks about the highlighted conditions, but the smaller scenarios of ₹5 lakh or ₹10 lakh are not in the media. There are instances from branches in tier 3 and tier 4 metropolitan areas which are viewing incredibly superior restoration.