Contents

Apple suggests it will enable app developers in South Korea to empower 3rd-celebration payment methods in their applications. In executing so, builders will no for a longer period be pressured to shell out a 30% minimize of their gross application income for applying the App Store’s own in-app payment system.

Inspite of yrs of developer backlash, Apple has been adamant about forcing builders to use its in-dwelling payments technique for handling in-application buys and membership payments. Apple’s grip was so limited that the organization didn’t wait before kicking a bonafide revenue-producing device like Fortnite off the App Retail outlet because Epic experimented with to prevent the Apple tax with its very own payment program.

Fortnite has been absent from the Application Retail outlet given that August 2020, but the whole saga ignited a debate that has pressured Apple to make a couple landmark modifications in two markets – South Korea and the Netherlands. In March this year, an modification to the Telecommunication Business enterprise Act was accepted in South Korea. As per the country’s regulatory overall body (the Korea Communications Commission), the tweak will prohibit brand names like Apple and Google from “forcing a specific payment strategy to a company of cellular articles.”

A few months later, Apple has ultimately enabled the plan for builders in South Korea, liberating them from the App Shop tax. It sounds good on paper, but the highway ahead for builders is much from rosy, and nearly seems like a bunch of punitive disorders for placing cracks in its walled backyard. But there’s much more to this pressured improve of heart than it appears.

The significant service fees are not going everywhere

The hangups are viewed suitable off the bat. If developers want to use other payment systems rather of Apple’s, they’ll be issue to a 26% fee for all in-app payments built by people. And that’s right before any other processing service fees and dues. For context, which is just a 4% lower fee than the 30% reduce Apple prices flagship builders and substantially additional than the 15% commission charged for smaller builders.

Apple does not say why it is charging the 26% reduce of income below. On the other hand, Apple has regularly argued in the past that routine maintenance of the App Retailer is a dear endeavor. Plus, Apple also offers perks such as payment help, fraud defense, indemnity, insurance policies, assistance with law enforcement, theft defense, and so on.

Offering developers a free hand by not charging a charge wasn’t heading to be a sustainable company product. However, builders have argued that it is more about the higher taxation than abandoning all the attributes talked about earlier mentioned. The protest was constantly about charging a significantly less exorbitant price, fairly than inquiring Apple to go all benevolent on builders.

If you are a tiny developer, it makes extra sense to pay a 15% tax by sticking to Apple’s individual payment technique with the App Store Tiny Small business Application, rather than skirt about the Application Shop tax and spend a increased 26% charge. For developers in South Korea, a reduction in App Store tax from 30% to 26% won’t make a great deal of a variation, except if they engage in at a world-wide scale with a enormous user base.

A region-locked ploy with several chores

The meager 4% aid that Apple offers is limited to apps exclusively dispersed in South Korea. As well as, it is not a cakewalk to help save that 4% minimize of the app earnings. Developers will have to share their every month profits with Apple in just 15 days of each individual month’s completion — facts that Apple will audit just before it will take its lowered 26% slice.

The first move toward ditching Apple’s in-app payment technique is the StoreKit External Acquire Entitlement, which requirements to be requested by means of a kind. Developers will have to furnish specifics this kind of as their app’s bundle ID, payment company supplier, web-site domain, and particulars about the shopper aid internet site that will deal with payment-associated grievances.

Apple at this time gives a decision of only 4 payment company vendors (KCP, Inicis, Toss, and Wonderful) to approach in-application transactions. If a developer wants to depend on a different payment channel, it will initially have to submit a request for that specific Payment Services Company that demands to be permitted by Apple.

That is not effortless both, as Apple has outlined exhaustive basic safety and versatility requirements for external payment company vendors, all of which have to have to be authorized prior to developers can integrate their payment expert services into their app. In a nutshell, developers conserving 4% of the Application Retail outlet tax also relies upon on Apple approving the payment service supplier of their option.

A lot more function for developers

Another key aspect is that builders will need to have to post a independent binary of their app to get acceptance for the exemption, which formally goes by the name StoreKit External Buy Entitlement. This application binary is essentially a clone of the application that will use an external payment process and will be dispersed solely in South Korea.

The variation that is obtainable to people in other nations will continue on to use Apple’s possess payment program, and as these kinds of, developers will still have to pay a 30% cut from the overseas revenue. Also, developers will also have to make some adjustments in the South Korea-specific application binary — such as updating the Xcode package and tweaking the StoreKit APIs in advance of it’s submitted for evaluate.

An additional essential piece of the puzzle is that an application developer can only opt for one route – either go with a third-occasion payment assistance company or adhere with Apple’s program. But the two solutions can’t co-exist. Apple is also forcing this kind of applications to allow payment processing inside the app and has explained to builders that they can not redirect end users to a browser for completing a transaction.

Expensive application user, you’re on your very own

Even immediately after crossing all all those hurdles, there’s a sea of risks for developers willing to help save that cherished 4% income. Apple warns that if an app is identified engaged in scammy, bait-like, or fraudulent functions, it will be taken off from the App Retail outlet and the developer’s Apple license will also be revoked.

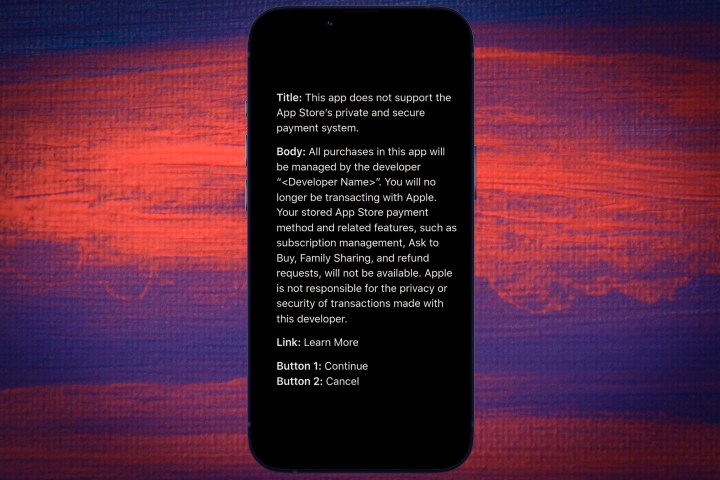

But that is not all, as the genuine psychological exam begins when an app offers the selection of a third-celebration payment gateway to people. Each individual app that relies on an external payment services will clearly show a concept to buyers informing them about it. This unavoidable headache tells users that they are leaving Apple’s secure ecosystem to make a payment and that Apple isn’t responsible for what takes place next.

There is certainly no breathing room at this issue. A developer will be “following particularly the modal sheet’s structure and textual content furnished,” says Apple. This warning information will flash just about every solitary time end users want to make a payment. Plus, buyers will also be needed to enter the payment facts each individual single time, so make absolutely sure to maintain your credit history card useful.

It’s the two cumbersome for the consumer, and an powerful scare tactic, specially for users who arrive to Apple’s ecosystem for its security and comfort. These types of a set up poses a tangible threat of user exodus, which is anything developers need to be extremely worried about. There are always rivals prepared to pounce on the prospect by supplying what users look for.

What this implies for the U.S. and other markets

It is rather evident that Apple will not let go of its Application Keep tax the effortless way. For developers inclined to glimpse the other way, they will save a paltry 4% of their earnings, but only following a cumbersome system that comes with a really real possibility of end users abandoning the application in favor of anything extra easy and protected.

Of course, Apple bending the guidelines in South Korea is a important breakthrough, but that does not necessarily mean it is heading to have an immediate global influence. In the Netherlands, Apple will only make it possible for relationship applications to use third-social gathering payment expert services. For the rest of the world, specially in Europe, Apple will struggle ferociously to protect its Application Retailer profits minimize.

Assuming Apple loses the battle in crucial marketplaces like the U.S. or Europe (which is where by the opposition is strongest), we can very likely hope a related set up as what South Korean builders have been handed. For a majority of developers out there, the chores and pitfalls that arrive with a reduced 26% fee merely aren’t really worth the difficulty. Plus, it places Apple in a much better place where by it can boldly claim that 26% is the correct price tag for hosting an application on its repository.

Apple is not likely to allow sideloading anytime shortly, if at all, which signifies builders will have no other alternative to distribute their application other than the App Keep. If a South Korea-like policy is forced in additional markets, Apple can also start out imposing arbitrary charges for listing apps, primarily based on metrics these kinds of as download figures and uncooked paying out among the other individuals.

Deep pocket developers can very easily pay Apple to get a plum settlement in this sort of a situation, but it is the modest builders that will bear the brunt of these a long term. There’s already precedent for that. According to a Financial Moments report, Apple already lets the likes of Facebook and Snap to skirt all around the Application Monitoring Transparency (ATT) framework for amassing consumer data. An App Retailer tax situation that threatens Apple’s income influx won’t be any distinctive.

Editors’ Tips