Contents

Most of us simply love to score high in terms of financial score, because that indicates how good we are performing financially. Definitely, if you are wondering what is considered as a good credit score, then for the answers, the list is going to be huge. Those three numbers are something that is undoubtedly going to make a massive difference to your financial profile now and then. A satisfying credit score is something that is recognized in several aspects and might delight your creditors, banks, landlords, and money lenders. If you are wondering what’s a good credit score, then here’s a quick breakdown of it.

This numerical representation ranges typically between 300 to 850, and the model utilized to calculate is the FICO model. Yes, your creditworthiness is judged based on these numbers whenever you apply for a new mortgage, loan, or a credit card. Mainly, the financial bureaus like TransUnion, Equifax, and Experian also consider your score for determining your financial eligibility.

- Excellent scores vary from 750-850 — Eligible for lower interest rates and reward offers

- Good scores range from 690-719 — Eligible for fair interest rates

- Fair/Average scores vary from 630-689 — Loan or credit card approval is possible in rare cases

- Poor scores range from 300-629 — Meager chances of loan or mortgage might be harder most of the time.

Benefits when you get to know the importance of what’s considered as a good credit score are limitless. But you need to have an active approach when it comes to paying your payments or EMIs on time. Here we have put together a few convincing benefits that you receive with a competent credit score.

-

Attractive interest rates on mortgages

The foremost advantage you get is that you can avail of lower interest rates on mortgage or loan approval. Receiving so can immensely help you to pay off your EMIs at a faster pace without any delays. Hence, it lowers your financial burden while enjoying other benefits as well. They can be gift coupons, reward points, and attractive festive offers. Remember that even a slight delay can bring you many points down. So make sure to have timely payments to enjoy big-ticket offers.

-

Easy chances of approval

Every money lender extracts your credit report to check your current score, mainly when you apply for a mortgage or credit card. In financial terms, it is known as a hard inquiry that has a slight effect on your credit score. There can be chances that your approval might get denied, or you simply receive a refusal for your application. But when you know what a good credit score is, and how to maintain it evenly; your approval chances are guaranteed on better terms.

-

Having higher credit limits

Your income and an excellent score contribute to your loan or credit card approval. In simple words, your applications for loans or credit cards with high financial limits becomes possible. Whereas with a lower score, you might have to pay the amount with higher interest rates while the capital amount may be lower than expected. Consequently, now you must be clear how a good credit score helps you with better offers.

Now, let’s move onto knowing what needs to be maintained for a good credit score?

Well, it is only possible if you hold responsible credit behavior, and we have made it easier for you! Here we have shortlisted the most apparent factors that can help you in achieving an excellent credit score.

-

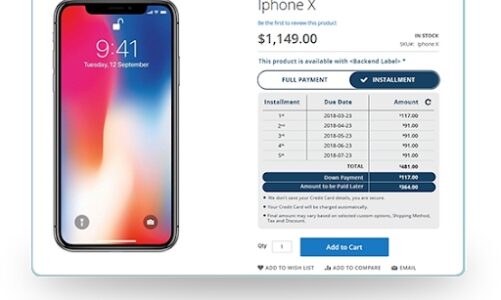

Payments on time

The significant role is played by the monthly installments that should be paid on time. It immensely holds a weightage of almost 35% of your credit score. You need to ensure that you are onto 100% positive repayment. Never miss any single payment; only then can you enjoy substantial credit health. It will not only give you peace of mind but will also indicate your sense of responsibility to the creditor or money lender, anytime you apply for a loan or a mortgage.

-

Follow the credit utilization ratio

Experts always recommend following the credit utilization ratio – which simply means regaining 30% of your credit limit. So better use a credit card only when it is essential, during emergencies or when you don’t have cash in hand. Limiting this habit of yours and only accommodating 30% of the total credit limit will help you in gaining an excellent credit score eventually.

-

Avoiding credit applications

There can be times when you might get desperate to have a new credit card, and you may feel like applying for it through multiple lenders. But it would be best if you remembered that each time you ask for it, a hard inquiry adds to your profile. And of course, that is going to reflect in your credit score. The bottom line is that having several hard inquiries can make you stand in a tight spot, and you may not get approval for your application.

Ultimately, not everyone has a credit score, and definitely, not everyone here is aware of what’s considered as a good credit score. So make sure to do thorough research before applying for a credit card or a loan. If you find the financial terms a bit complex, then better seek professional advice from any of the certified credit repair agencies near you. Always remember everything is not going to change within a couple of days. So have patience and practice the best measures to stay on the top!