Vauld, a Singapore-headquartered crypto lending and exchange startup, has suspended withdrawals, buying and selling and deposits on its eponymous system with fast effect as it navigates “financial challenges,” it mentioned Monday.

The three-calendar year-outdated startup — which counts Peter Thiel-backed Valar Ventures, Coinbase Ventures and Pantera Cash among the its backers and has elevated about $27 million — claimed it is struggling with fiscal issues amid the market place downturn, which it mentioned has prompted consumer withdrawals of about $198 million due to the fact June 12.

Vauld founder and main govt Darshan Bathija claimed the startup is discovering restructuring choices and has engaged with Kroll for financial tips and Cyril Amarchand Mangaldas and Rajah & Tann for legal information in India and Singapore.

The startup intends to utilize to the Singapore courts for a moratorium. “We are self-confident that, with the assistance of our monetary and lawful advisors, we will be ready to get to a resolution that will finest protect the passions of Vauld’s buyers and stakeholders,” he wrote in a site article, adding that the startup will make “specific arrangements” for sure prospects who require to meet their margin calls.

It is unclear how many users Vauld serves.

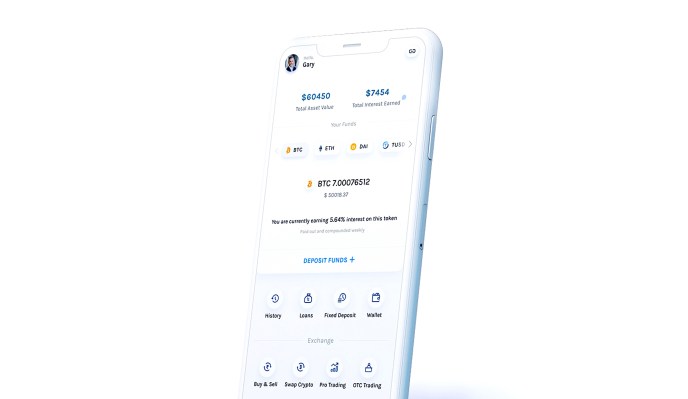

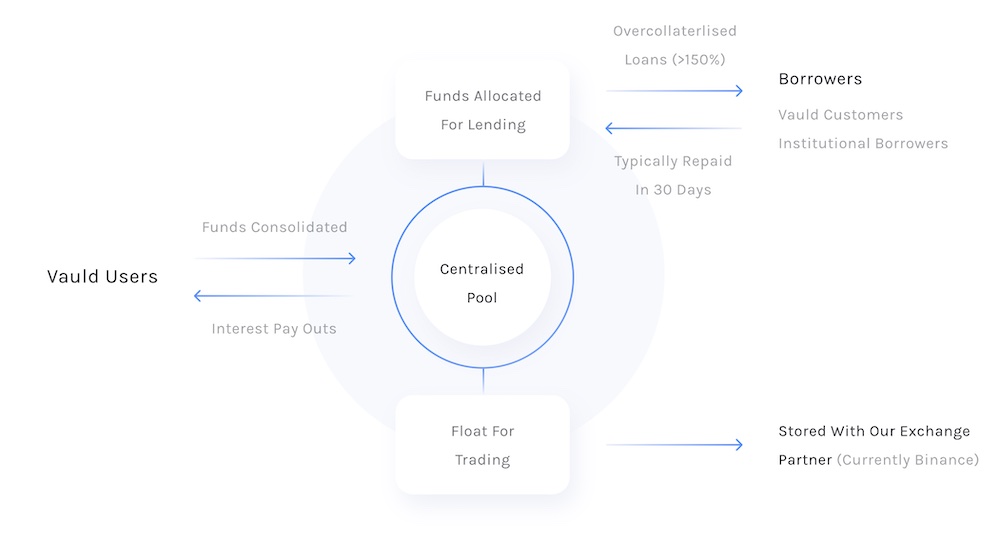

Vauld enables shoppers to gain what it promises to be the “industry’s maximum curiosity costs on big cryptocurrencies.” On its web page, it suggests it presents 12.68% annual yields on staking a number of so-named stablecoins together with USDC and BUSD and 6.7% on Bitcoin and Ethereum tokens. The system allowed buyers to borrow versus their tokens and also facilitated various other trading products and services.

On its website, Vauld claims it presents buyers the skill to borrow up to an LTV (personal loan to worth) of 66.67% versus their tokens and “instantly” approves their financial loans. Like various tech shares, quite a few crypto tokens have tumbled by more than 70% in price in the previous 6 months.

“We seek out the comprehension of shoppers of the Vauld platform that we will not be in a position to system any new or even further requests or directions in this regard. Particular preparations will be designed for buyer deposits as may perhaps be important for certain consumers to fulfill margin calls in link with collateralised financial loans,” Bathija wrote today.

The announcement follows Vauld slicing its workforce by 30% two weeks in the past.

The shift comes as a surprise. On June 16, Bathija certain Vauld consumers that the platform experienced no exposure to Celsius, an additional lending startup that is dealing with growing economic troubles, and Three Arrows Capital, 1 of the higher-profile crypto hedge funds that filed for a Chapter 15 individual bankruptcy more than the weekend.

“We remain liquid in spite of marketplace conditions. Above the final handful of days, all withdrawals ended up processed as usual and this will keep on to be the circumstance in the long term,” Bathija wrote earlier.

Numerous crypto veterans which include Binance founder and chief executive Changpeng Zhao have warned in current months that several extra DeFi platforms are on the verge of experiencing a collapse. In a latest podcast, Zhao reported Binance has engaged with over 50 corporations in recent months to evaluate funding / bailing out possibilities in some companies.

“The identical promotions that you see in the information of other men and women looking at, they normally appear to us very first,” he explained. “We have the most significant funds reserves of any exchange. We like to preserve the field as significantly as achievable, but not all initiatives are truly worth conserving.”

On Friday, FTX’s U.S.-centered arm inked a deal with troubled crypto loan company BlockFi that gives the crypto exchange the possibility to purchase the startup for up to $240 million based on the startup’s overall performance. BlockFi, which was amongst the corporations that liquidated at the very least some positions held by A few Arrows Funds, was valued at $3 billion in a financing spherical it disclosed in March 2021.