Contents

The unpredictable era of the Covid-19 pandemic has shaped the world in its way. It fueled online shopping habits and marked the peak of the eCommerce growth rate. Along with such massive growth opportunities for the businesses, it hauls a lot of challenges to survive in such a highly competitive market.

Businesses are pushing their limits at providing the utmost convenience to their customers to have a competitive edge. A ‘Buy Now Pay Later’ payment option is one such convenient feature that businesses harness to allure and retain customers.

The ‘Buy Now, Pay Later’, abbreviated as BNPL, has become a prevalent payment facility in the eCommerce world, replacing credit-card payments in the last few years.

But…

- What exactly is ‘Buy Now, Pay Later’?

- Why is it getting so popular?

- How does it affect businesses?

If you are an eCommerce store owner thinking about leveraging this facility in business, keep reading. Also check Magento 2 Partial Payment by Meetanshi allows the store owners to sell products on part payment, layaway or instalment payment plans for customers’ convenience. In this article, I have covered everything about BNPL in eCommerce.

‘Buy Now Pay Later’ – Explained in a Nutshell

Like the name suggests, ‘Buy Now Pay Later’ is a payment facility that allows the customer to purchase a product by paying a small due amount at the time of purchase and later repay the remaining amount over time.

Generally, in BNPL, the total purchase amount is divided into equal instalments to be paid at regular intervals by the customer. There is no or low interest charged by the business on the amount in most of the cases.

These later facilities are financed by third-party banking institutions and companies such as Klarna, Affirm. It is being used by the eCommerce businesses, including the behemoths such as Amazon and Flipkart, to optimise their average order value by encouraging the customers to make bigger purchases.

How Does ‘Buy Now, Pay Later’ Work?

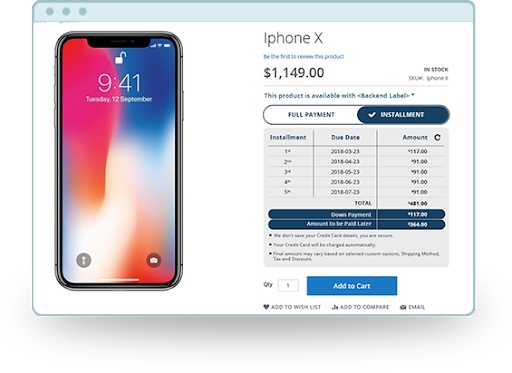

The working principle behind the ‘Buy Now Pay Later’ facility is different for different providers. Generally, on the checkout page, the customers are provided with complete ‘Buy Now Pay Later’ details, including the down payment, amount to be paid later, the number of instalments, and due dates.

Provided below is an example of a typical eCommerce site offering a ‘Buy Now Pay Later’ facility on the checkout page.

After choosing the preferred BNPL option on the checkout page, the customer can place the order by paying the down payment amount. The remaining amount of the order is generally auto-captured regularly through instalments.

Facts & Figures About ‘Buy Now Pay Later’ Facility

The ‘Buy Now, Pay Later’ payment facility has progressed by leaps and bounds in the finance industry. Below are some of the interesting facts and figures about the BNPL facility that might surprise you.

Most Popular BNPL Facility Provider

According to Statista, Klarna is the most downloaded BNPL app in the UK, with a market share of 5%. The same report suggested that Klarna, Affirm, Afterpay, and QuadPay were the most popular BNPL apps in the US, with more than 1.4 million monthly instals.

Why Do People Prefer Using BNPL?

In eCommerce, the customers opt for the BNPL payment facility for a couple of reasons. In a poll by Ascent, avoiding high credit-card interest rates and purchasing products beyond the purchasing power were two of the major reasons why Americans use the BNPL facility.

Exponential Growth of BNPL During the Pandemic

The pandemic had a drastic impact on the global economy and has affected the pockets of customers worldwide. This resulted in the customers opting for an affordable payment option such as the BNPL facility to purchase pricey products.

According to one report by Statista, the use of flexible payment options such as Klarna, Afterpay, PayPal’s Pay in 4, and QuadPay increased exponentially during the global pandemic.

Millennials & Gen-Z – The BNPL Lovers

The rise of the ‘Buy Now, Pay Later’ facility usage is spreading throughout the demographics. However, surveys and studies show that most of the BNPL usage growth comes from Millennials followed by young customers.\

It is also expected that the Gen-Z customers will soon contribute a major role in the growth of ‘Buy Now Pay Later’ facilities.

‘Buy Now, Pay Later’ vs. Credit Card EMIs

Credit cards are some of the most preferred ways of online payment for customers. Credit card EMIs provide customers to purchase online products in easy monthly instalments, yet it is a bit different from ‘Buy Now Pay Later’.

Usually, credit card providers offer EMIs on purchases with high-interest rates and hiding charges. On the other hand, the BNPL facility provides a low or no interest instalment facility to the customers. Moreover, credit cards require a minimum credit score to avail the facility of deferred payments, whereas it is not required in the pay later plans.

In the case of the BNPL facility, the customers can repay the instalments through any payment methods offered by the merchant while they are bound to auto-deduction from the card in case of credit card EMIs.

In short, the pay later facility provides a more cost-effective and convenient flexible payment option to the customers as compared to the credit card EMIs.

The ‘Buy Now, Pay Later’ Experience

The pay later facility of online payments is trending for some solid reasons. The ‘Buy Now, Pay Later’ facility is profitable to the businesses and is also beneficial to the customers, creating a win-win situation in the eCommerce market.

Here is how the pay later facility experience is luring the customers and benefiting the businesses.

For Customers

Ultimately, the end customers and their experience with the ‘Buy Now, Pay Later’ facility act as a growth-driving factor. It has witnessed tremendous growth in the last few years because of the convenience and benefits that it provides to the customers. Provided below are some of the key benefits of the ‘Buy Now Pay Later’ facility for the customers:

- Increased Purchasing Power: The ‘Buy Now Pay Later’ functionality facilitates the customers to purchase pricey products through affordable instalment plans. This makes it possible for the customers to purchase the products without having to pay the full price of the product at once.

- Highly Convenient: Availing instalment facility through the BNPL facility does not involve any complex steps. Unlike credit card payment options, it facilitates the customers to avail a flexible payment method during the checkout without much hassle.

Using the ‘Buy Now, Pay Later’ facility, the customers can easily purchase products just by paying a little part of the whole amount. Also, it does not require any kind of background checks or minimum credit scores.

- Low-Cost Instalments: Customers hate bulky interest rates and additional charges associated with credit card payments and EMIs. This is one of the major reasons for customers to choose BNPL over credit cards.

Generally, the BNPL programs provide instalment facilities at low or no interest rates. Therefore, it becomes a good option for the customers that are looking for instalment facilities to buy expensive products.

For Retailers

The advantages of the pay later facility are not just limited to the customers only. The businesses are providing the facility also because of the sales benefit that it harnesses for them.

Provided here are some of the key points on how the merchants are leveraging their business through the BNPL facility:

- Earns Customer Loyalty: Customers love to purchase products through affordable payment plans such as ‘Buy Now Pay Later’. Providing such convenient and flexible facilities improves the customer experience and enhances customer loyalty towards the brand.

Customers who have opted for a ‘Buy Now Pay Later’ facility will have to pay regular instalments over time. This creates a long-term relationship with the brand and also boosts Employee retention.

- Lifts Conversions and AOV: Providing a BNPL facility to the customers can encourage them to purchase expensive items and thereby increasing conversion rates and average order value.

Sometimes, the businesses may also charge little later fees to generate extra revenue out of those orders.

- Helps Stand Out From The Crowd: Convenient and flexible payment facility is essential to allure the customers for a product. The eCommerce market is highly competitive and incorporating such a highly convenient payment facility helps have a competitive edge and helps brands to stand out from the crowd.

The Bottom Line

In a nutshell, the ‘Buy Now Pay Later’ facility is a customer-centric payment solution offered by a majority of the leading retailers. In contrast to the credit card EMI payments charging bulky interest rates, the pay later functionality provides easy, quick, and convenient payment options.

Incorporating this facility in business can make things work for both the retailer and the customer. There are plenty of benefits of using the ‘Buy Now Pay Later’ facility for the customers and businesses as well. Customers love payment convenience and offering flexible payment options on the checkout page can add to the customer loyalty towards the brand.

It is currently trending as one of the most preferred payment options for Gen-Y and Z customers, and its usage is expected to increase further in the future.